About to retire

Retiring earlier or later

Some people can't wait to retire. Others never want to stop working. What are you going to do?

Do you know when you want to retire?

Many people dream of retiring before the statutory retirement age. Others prefer to continue working for a while. It is important to think about this well in advance. Because retiring earlier or later can have consequences for your pension income.

Retire earlier

Would you like to retire earlier? Then start preparing in time. Because retiring early can have consequences for your pension income. We have listed all the important points for you.

Retire later

If you want to continue working after reaching your state pension age, you postpone your retirement date. This can be done up to a maximum of 5 years after the state pension age. You can read how to do this here.

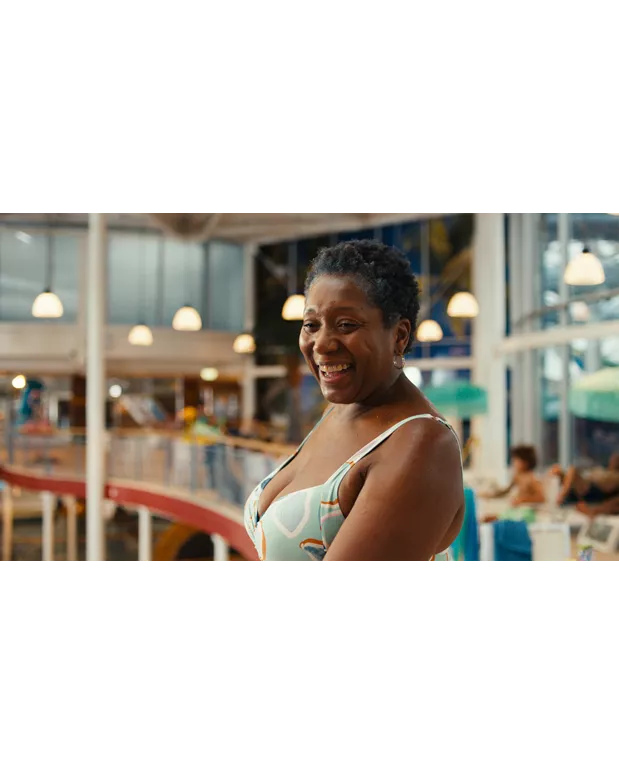

Jane retired 3 years later

“I remember someone from human resources coming up to me, asking me to start thinking about 'reducing hours'. And all I could think was: reducing? The kids had already left home, so I just wanted to keep working for a while longer!”

Read more

This is what you need to know.

Choosing to retire earlier or later depends, among other things, on your retirement date and your state pension age. You can retire before the state pension age, at the state pension age, or after. And you can postpone each pension pot or (usually) start it earlier. The state pension benefit cannot be started earlier or later.

Need advice on this choice?

Consult an independent financial adviser. Get assistance with your decisions.

When do you want to retire?

- State pension

- Pension

- 62

- AOW leeftijd

- 72

Stan, 65 years old

“I have chosen to retire later. Still had plenty of energy, and I hope to build up more pension this way.”

Frequently asked questions

Webinar

Have you already decided what you want to do with your pension?

Wednesday 12 November 2025 19:00 - 20:00 (length: 1 hour)

In this webinar, you'll discover the decisions you need to make and how to go about making them.

Know what's going on

You want to make the right choices for the future, don't you?

Subscribe to our newsletter to receive important updates about your pension and other interesting topics a few times per year.