About to retire

How do you retire?

Soon, the time will come for you to retire. It is okay if you're not thinking about it yet. We're here to help you to get started.

What happens to my pension if I...

Your pension forecast in under a minute?

What you're about to calculate is an estimate of the pension you can expect later on. This estimate is not individual advice and no rights can be derived from it. The actual outcome depends on various factors, such as interest rates and the performance of your investments.

Top 10 best things to read before you retire

Stopping earlier, is that possible?

Gerard has found his calling: training football teams as a volunteer. He even quit his job for it earlier to pursue it.

Security? Or a bit more risk?

Anton ran behind others his whole life. Now he's retired, Tobi is the only one running around.

Merging pension pots?

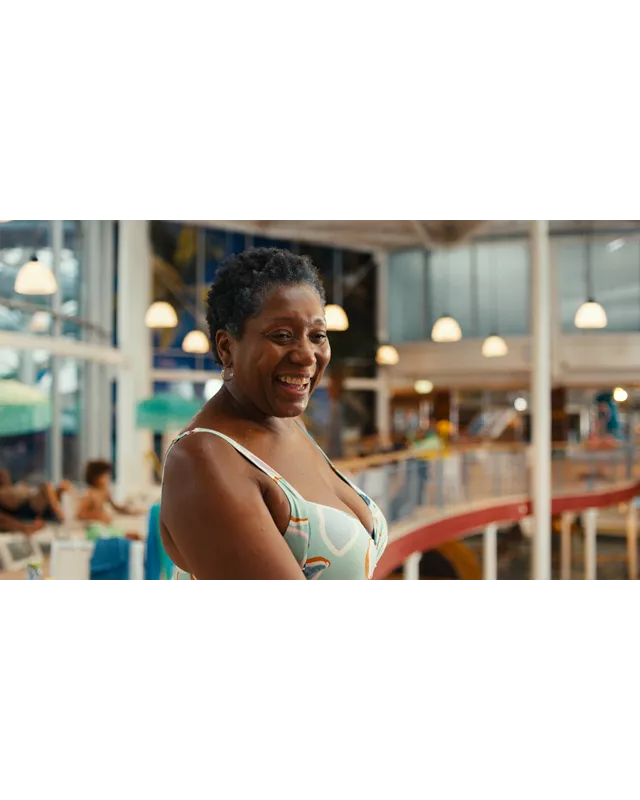

Jane has had a lot of employers throughout her career. Now she's retired, and has all the time in the world for her grandchild.

Partly retiring?

Thea worked at a law firm her whole career. And chose to keep working parttime after her pension date.

Directly to

Saving your data

When you create an account or log in, you will always see information relevant to your situation.

I have a question

Are you having trouble finding something? Call us or send us a message.

Request personal advise

We do not provide advice. But if we were to give you one piece of advice: an independent adviser does.

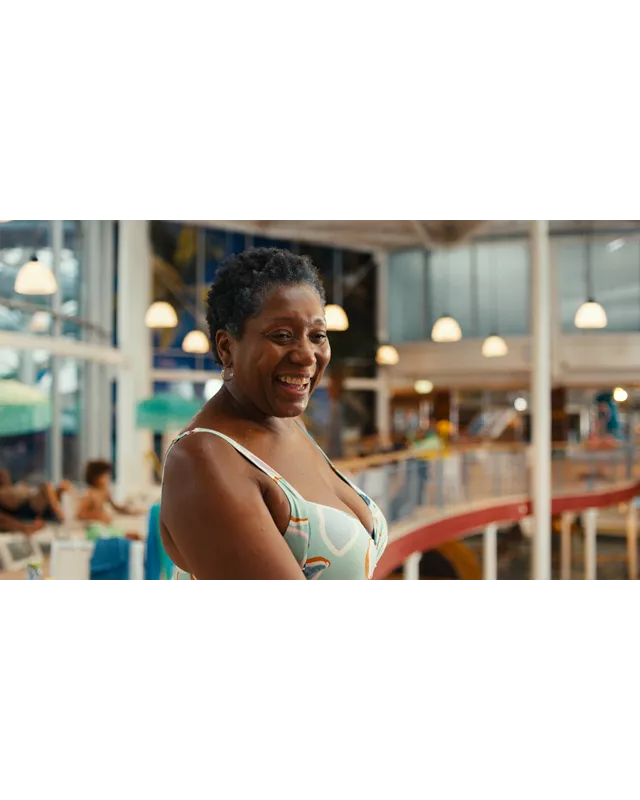

Advanced pension Enjoyment

“Making a checklist really helped me...”

“I was really looking forward to my retirement, but at the same time, I was dreading it because of all the administrative hassle involved. By making a checklist, I found peace of mind. And now I'm thoroughly enjoying my free time, knowing that everything is in order...” Curious about Jane's full story or that of other experienced retirement enthusiasts?

Apply for your pension now!

Retiring within 6 weeks? Take action!

Webinar

Have you already decided what you want to do with your pension?

Wednesday 12 November 2025 19:00 - 20:00 (length: 1 hour)

In this webinar, you'll discover the decisions you need to make and how to go about making them.

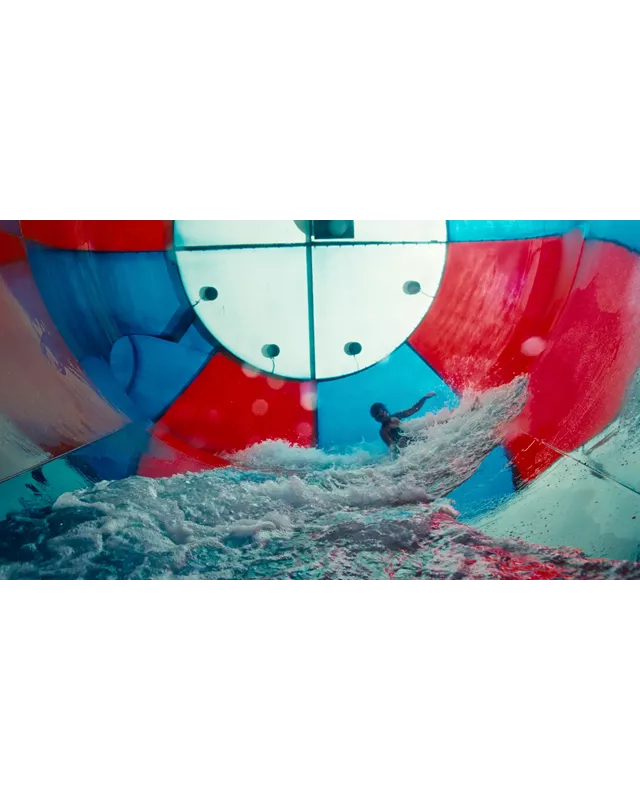

What are you going to do during your retirement?

Retirement is a new beginning for many people. What are you going to do? Take up hobbies? Travel? Volunteer? Or just do nothing at all?

Discover our e-book.